compensation report

Dear shareholders

On behalf of the Compensation & Nomination Committee, I welcome this opportunity to present the Compensation Report for the financial year 2016.

At the 2015 General Meeting, the Ordinance against Excessive Compensation in Listed Companies Limited by Shares (VegüV) – incorporated in the Articles of Association at the 2014 General Meeting – was implemented for the first time. Since then, separate votes are taken on the maximum combined compensation for Board of Directors members up to the next scheduled General Meeting, and the maximum compensation for Group Management and Extended Group Management are approved prospectively for the forthcoming financial year. In a consulting vote, the Compensation Report is also submitted to shareholders for approval.

Ernst Tanner (CEO) took over the role of Executive Chairman on October 1, 2016. The Board appointed Dr Dieter Weisskopf, previously the Group’s CFO, to succeed Mr. Tanner as CEO. In a move to simplify the management structure, Group Management and Extended Group Management were merged on January 1, 2017. Following a number of personnel changes, Group Management now has nine members.

This Compensation Report is structured as follows:

I. Compensation governance

II. Compensation for the Board of Directors

III. Compensation for Group Management and Extended Group Management

i. Compensation principles

ii. Compensation system

iii. Compensation elements

iv. Compensation

IV. Employment contracts

V. Participation

VI. Additional fees, compensation, and loans to company officers

The Board of Directors is convinced that this 2016 Compensation Report gives you, our valued shareholders, a comprehensive and integral overview of compensation for upper management at Lindt & Sprüngli Group.

Dr R. K. Sprüngli

Chairman of the Compensation & Nomination Committee

Compensation report 2016

This Compensation Report describes the underlying principles governing compensation for the senior management of the Lindt & Sprüngli Group. The information provided refers to the financial year ending December 31, 2016. The Compensation Report also incorporates the disclosure obligations set out in Art. 14 ff. VegüV and Art. 663c OR, the revised provisions of Chapter 5 of the Corporate Governance Directive of the SIX Swiss Exchange and the revised recommendations of economiesuisse “Swiss Code of Best Practice for Corporate Governance” in its last published version, February 29, 2016.

I. COMPENSATION GOVERNANCE

Article 24bis of the Articles of Association of Lindt & Sprüngli allocates the following tasks and competencies for the Compensation & Nomination Committee (CNC):

“The Compensation & Nomination Committee shall concern itself with compensation policies, particularly at the most senior levels of the company. It shall have the tasks, decision-making powers, and authority to present motions accorded to it by the organizational regulations and the Compensation Committee regulations. In particular, it shall assist the Board of Directors in determining and evaluating the remuneration system and the principles of remuneration, and in preparing the proposals to be presented to the General Meeting for approval of remuneration pursuant to Art. 15bis of the Articles of Association. The Compensation & Nomination Committee may submit to the Board of Directors proposals and recommendations in all matters of remuneration.”

Governed by the corresponding bylaw, the responsibilities of the CNC thus also include the approval of employment contracts for Group Management members and the submission of proposals to the Board of Directors on the employment contract for the CEO for approval. The CNC also submits proposals to the Board of Directors for motions relating to compensation to be approved by the General Meeting and for any occupational benefits and pensions of the company or of its subsidiary companies – outside the scope of occupational benefits and similar schemes abroad – granted to members of the Board of Directors, Group Management, and Extended Group Management within the limits defined by the Articles of Association. The CNC is also responsible for drawing up a proposed Compensation Report text to be reviewed and approved by the Board of Directors.

Within the framework of the compensation principles, Articles of Association, and resolutions of the General Meeting, the CNC determines the amount and composition of compensations for individual members of Group Management and submits proposals to the full Board on the individual compensation of the CEO and the members of the Board of Directors. Individual members of the Board of Directors and Group Management are excluded from these negotiations, and from voting, when their own compensation is affected. Once a year, the CNC informs the Board of Directors about the procedure for compensation determination and the outcome of the compensation process. The CNC meets at least twice each year; three regular meetings were held in the year under review, with only one member absent at one of the three meetings. The CNC has general authority to call in external consultants to perform its tasks. Last year, the advisory services of a well-known consultant were used in connection with the benchmarking of the compensation paid to the Executive Chairman and Group Management, this was the only project involving work with this consulting firm.

Compensation approval system

II. COMPENSATION FOR THE BOARD OF DIRECTORS

The members of the Board of Directors receive compensation exclusively in the form of a fixed fee. The entire compensation for the past term of office is paid out in cash after the General Meeting, in accordance with the table below. This compensation releases the Board of Directors from potential conflicts of interest in the assessment of corporate performance.

The same fixed flat-rate fee was paid to the Board for the term of office 2015/2016 and 2016/2017: CHF 260,000 for the Chairman, and CHF 145,000 to the members of the Board. The following compensation was effectively paid to the members of the Board of Directors in the year 2015/2016:

Compensation of the Board of Directors (audited)

1 Total compensation in the form of a fee.

2 Remuneration for the function as Chairman of the Board (with no executive responsibilities; for these additional duties the Executive Chairman is entitled to compensation under the terms of the employment contract terminated prematurely on April 30, 2017).

3 CS Committee: Corporate Sustainability Committee.

4 AHV share of the employee on fees paid by the employer (including that of the employer, that establishes or increases social insurance or pension contributions). Mr. Bulgheroni also received a gross fee of TCHF 28 in 2016 for his function as Chairman of the Board of Lindt & Sprüngli SpA and Caffarel SpA (previous year TCHF 28). Ms. Schadeberg-Herrmann received a fixed compensation of TCHF 13 for her consulting function at Lindt & Sprüngli (Austria) GmbH in 2016 (previous year TCHF 13).

5 Election at the General Meeting 2016. Fee is paid in April 2017.

6 Up to his decease in August 2015, Dr F. P. Oesch was a member of the Board of Directors and the Audit Committee. Payment of pro rata fee from May until August 2015.

The amount of CHF 1.1 million approved by the General Meeting of April 23, 2015, as the maximum combined compensation for the Board of Directors for the period up to the next General Meeting was not exceeded. The amount of CHF 1.1 million approved by the General Meeting of April 21, 2016, as the maximum combined compensation for the Board of Directors for the period up to the next General Meeting was not exceeded either. The amount effectively paid out will be disclosed in the Annual Report 2017. The combined compensation paid to the Board of Directors in 2016 was barely changed from the previous year.

No loans and credits were granted to current or past executive and non-executive members of the Board of Directors.

III. COMPENSATION FOR THE GROUP MANAGEMENT AND EXTENDED GROUP MANAGEMENT

i. Compensation principles

Compensation plays a central role in staff recruitment and retention, thus influencing the company’s future success. Lindt & Sprüngli is committed to performance-based compensation in line with the market and designed to reconcile the long-term interests of shareholders, employees, and customers. The compensation system at Lindt & Sprüngli has five main aims:

1. long-term staff motivation,

2. creating long-term retention of key employees,

3. establishing an appropriate relationship between the compensation and results,

4. ensuring that management activity reflects owners’ long-term interests; and

5. attracting talent and enhancing the company’s reputation as a good employer to work for.

Lindt & Sprüngli attaches great importance to staff retention; this manifests itself particularly in the extraordinarily low turnover rate over a period of many years in Group Management, Extended Group Management and country CEOs. This is particularly important for a premium product manufacturer with a long-term strategy. Compensation principles at Lindt & Sprüngli are meant to have a medium and long-term impact and be sustainable. Continuity is a high priority.

ii. Compensation system

Compensation for members of Group Management and Extended Group Management consists of a combination of basic salary, cash bonus, shares and participation certificate or option-based compensation and ancillary benefits consistent with their respective position. Fixed compensation essentially reflects the particular grade, powers, and experience of the members of Group Management and Extended Group Management. The cash bonus is tied to performance targets for the financial year, while compensation in equities, or similar instruments, strengthens the focus on shareholders within Group Management and reconciles the long-term interests of the Management with those of the shareholders.

Compensation in equities, or similar instruments with vesting periods of three to five years until they can be exercised, promotes the long-term focus so important in the consumer goods industry and has been a major pillar of the company’s development in recent years. The following table shows the particular bonus target as a percentage of basic salary, the accompanying target attainment bandwidth as a percentage of the bonus target, and elements of equity-based compensation. The bandwidth for possible option allocations is expressed as a percentage of the fixed compensation in each case.

Composition of Group Management variable compensation

1 Options on participation certificate.

2 Up to December 31, 2016.

The amount of target compensation is guided by the requirements and responsibility of the beneficiaries and is regularly reviewed within the Group through horizontal and vertical comparisons. When new appointments are made, the CNC also analyses comparable data for the consumer goods sector, with reference to the specific vacancy for the appointment.

In the financial year 2016, compensation for Group Management and Extended Group Management was reviewed by benchmarking. Here, the compensation level and its structure were compared with twelve industrial companies from the SMI and SMIM that were similar in terms of market capitalization and sales. In addition, the long-term corporate performance of Lindt & Sprüngli was determined by comparison with the peer group to obtain an assessment representing a “Pay for Performance” analysis. In addition, a benchmarking exercise was carried out, with the support of specialist consultants, with respect to the newly created position of Executive Chairman and Group Management compensation.

iii. Compensation elements

Basic salary and other compensation — The basic salary is paid out in twelve or thirteen equal monthly cash installments. In addition, members of Group Management and Extended Group Management receive other compensation and ancillary benefits, including entitlement to a company vehicle and participation in pension plans.

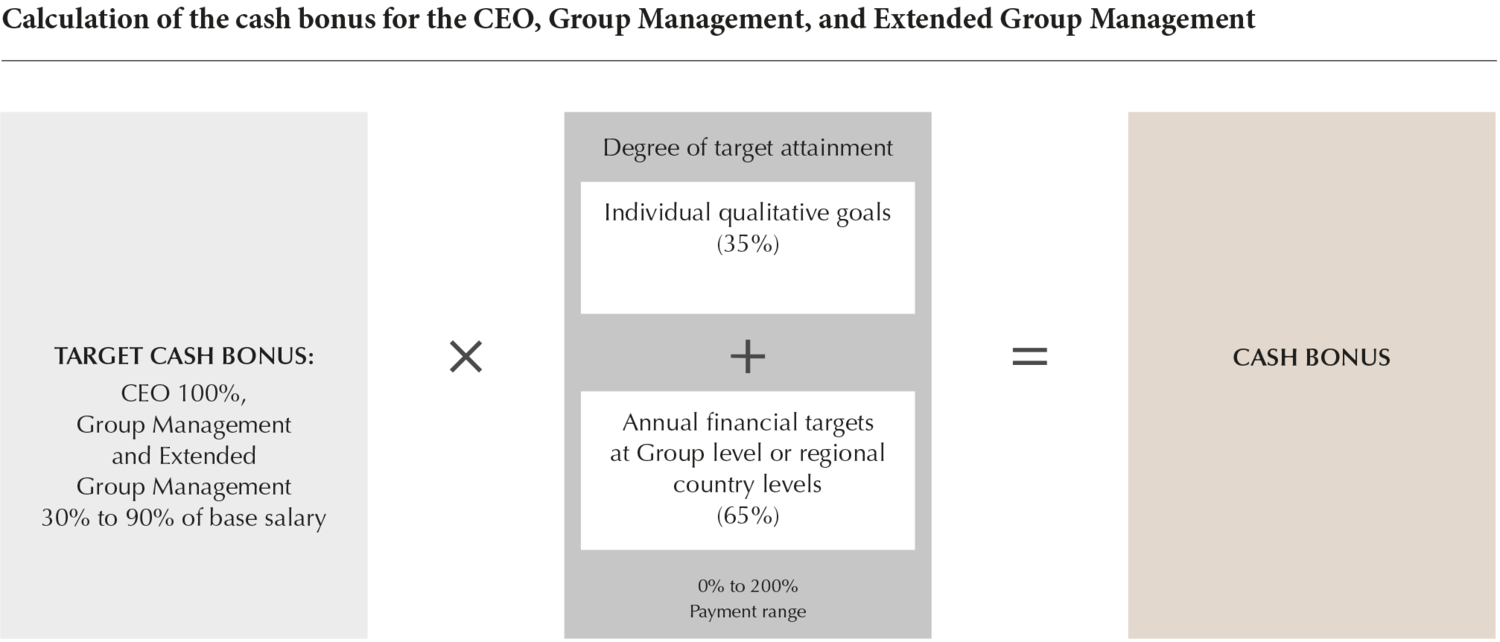

Cash bonus — The cash bonus is determined by multiplying the individual target cash bonus by a target attainment factor, determined by a scorecard. For the CEO and members of Group Management, this factor is determined largely by the attainment of financial targets for the year at Group level and, to a lesser extent, by the attainment of personal annual qualitative targets set by the CNC. The financial targets are determined annually and correlated with the long-term strategy, with the goal of achieving sustainable organic sales growth accompanied by continuous improvement in profitability. For financial targets, results achieved over the last three years on the market are also measured against our competitors to allow comparison of circumstances not influenced by the company itself. Non-financial targets are guided by the individual function and relate to strategy implementation and to defined management and conduct criteria.

For Extended Group Management, the target bonus multiplier is also determined using a scorecard, with multipliers mainly influenced by the attainment of established financial targets. For the members of Extended Group Management who have responsibility at regional or national level, regional and national financial targets are also considered, along with Group targets. For members of Extended Group Management, strategic and personal target achievement represents a comparatively small part of the bonus calculation.

As the following illustration shows, target cash bonuses for the CEO, members of Group Management and Extended Group Management are multiplied by each member’s achievement of the target, which ranges from 0% to 200% (maximum figure in excess of the set target). In other words, the cash bonus paid out is limited to twice the target cash bonus.

Share plan — The compensation in blocked shares, agreed contractually with the CEO when he was appointed in 1993, entitled him to a certain number of blocked shares every year. Since 2015, the CEO receives a variable quantity of up to 50 shares, depending on performance in previous years. The exact number of shares is decided by the CNC, as part of an overall assessment based on a scorecard and is determined by achievement of financial and non-financial targets measured over a period of three years. If the targets are not achieved, the number of shares will be reduced accordingly. The allocated shares continue to be subject to a five-year vesting period, during which they may not be sold; in other words, the long-term value is linked to the company’s value trend. Having assumed the post of Executive Chairman, the former CEO is no longer entitled to any share allocation. The new CEO, who took up office on October 1, 2016, is not entitled to the allocation of any blocked shares.

Option plan — The option plan enables Group Management and Extended Group Management, as well as selected key employees with expert knowledge, to participate in the long-term increase of the corporate value. The number is not determined primarily by previous year’s performance, but by the employee’s position and his influence on long-term corporate success. The CNC makes the final decision on option value per participant based on stated criteria; the allocated value may amount to as much as 200% of the specific basic salary for the Group Management, and Extended Group Management. The options are issued in a ratio of one option to one participation certificate (1:1). The option strike price corresponds to the average value of the closing price of the Lindt & Sprüngli participation share over the five previous trading days on the SIX Swiss Exchange prior to grant of the option.

Option rights have a strike period of not more than seven years from grant, with initial vesting periods of three (35%), four (35%), or five (30%) years.

iv. Compensation

Compensation for members of Group Management and Extended Group Management for the year 2016 and 2015 is shown in the following table. The valuation of the option and equity-based compensation for 2016 and 2015 uses market values at the time of grant.

Compensation for the Group Management and Extended Group Management (audited)

1 Total of paid-out compensation, including pension fund and social insurance contributions paid by the employer, that establishes or increases employee benefits.

2 Accrual at year-end for expected pay-out in April of following year (excluding social charges paid by employer).

3 Employees’ part of social charges (AHV) related to exercising of options and grant of registered shares, paid by employer.

4 Option grants on Lindt & Sprüngli participation certificates under the terms and conditions of the Lindt & Sprüngli employee share option plan (see also note 27). The valuation reflects the market value at the time granted. The total number of granted share options in 2016 to Mr. Tanner was 2,500 units (2,500 units in 2015) and to all other members of the Group Management and Extended Group Management 7,500 units (8,000 units in 2015).

5 50 Lindt & Sprüngli registered shares granted to the CEO in the business year 2016 (50 in 2015), with a 5-year vesting period, under the terms of the previous employment contract. The valuation is based on the market value at the time of grant.

6 The fixed base salary for function as CEO (excluding social security contributions) remains unchanged from 1993 to September 30, 2016.

7 Since July 1, 2016 (departure of T. Linemayr), there are six other Group Management and Extended Group Management members.

The amount of CHF 28 million approved by the General Meeting of April 23, 2015 as the maximum combined compensation for the Group Management and Extended Group Management was not exceeded; no use was made of the supplementary amount in accordance with Art. 15bis para. 5 of the Articles of Association.

No loans and credits were granted to current or past executive and non-executive members of Group Management and Extended Group Management.

IV. employment contracts

The employment contracts stipulate a maximum notice period of twelve months and make no provision for a severance payment. Maximum prohibition on competition for members of Group Management and Extended Group Management is twelve months. Compensation must not exceed the basic salary for one year. Vesting periods imposed on shares and options do not lapse with departure; vesting periods are not shortened.

V. Participation

The following table provides information on the ownership of Lindt & Sprüngli registered shares, participation certificates and options on participation certificates for members of the Board of Directors, Group Management, and Extended Group Management on December 31, 2016.

1 Mr. T. Linemayr left the Lindt & Sprüngli Group in 2016, therefore no participation is reported for 2016.

VI. ADDITIONAL FEES, COMPENSATION, AND LOANS TO COMPANY OFFICERS

Apart from the benefits listed in this report, no other compensation was provided in the reviewed year 2016 – either directly or via consultancy companies – to the executive and non-executive members of the Board of Directors or to the members of Group Management and Extended Group Management and to former members of Group Management and the Board of Directors as well as related persons. In addition, as per December 31, 2016, no loans, advances or credits were granted by the Group or by any of its subsidiary companies to this group of persons.

VII. compensation to former members

No compensation was paid to former members of the Board of Directors or to the members of Group Management and Extended Group Management.

Report of the statutory auditor

To the general meeting of Chocoladefabriken Lindt & Sprüngli AG, Kilchberg

We have audited the remuneration report of Chocoladefabriken Lindt & Sprüngli AG for the year ended 31 December 2016. The audit was limited to the information according to articles 14 – 16 of the Ordinance against Excessive Compensation in Stock Exchange Listed Companies (Ordinance) contained in the tables labeled “audited” of the remuneration report.

Board of Directors’ responsibility

The Board of Directors is responsible for the preparation and overall fair presentation of the remuneration report in accordance with Swiss law and the Ordinance against Excessive Compensation in Stock Exchange Listed Companies (Ordinance). The Board of Directors is also responsible for designing the remuneration system and defining individual remuneration packages.

Auditor’s responsibility

Our responsibility is to express an opinion on the accompanying remuneration report. We conducted our audit in accordance with Swiss Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the remuneration report complies with Swiss law and articles 14 – 16 of the Ordinance.

An audit involves performing procedures to obtain audit evidence on the disclosures made in the remuneration report with regard to compensation, loans, and credits in accordance with articles 14 – 16 of the Ordinance. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatements in the remuneration report, whether due to fraud or error. This audit also includes evaluating the reasonableness of the methods applied to value components of remuneration, as well as assessing the overall presentation of the remuneration report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Opinion

In our opinion, the remuneration report of Chocoladefabriken Lindt & Sprüngli AG for the year ended 31 December 2016 complies with Swiss law and articles 14 – 16 of the Ordinance.

PricewaterhouseCoopers AG

Bruno Häfliger

Audit expert

Auditor in charge

Richard Müller

Audit expert

Zurich, 6 March 2017

PricewaterhouseCoopers AG is a member of the global PricewaterhouseCoopers network of firms, each of which is a separate and independent legal entity.