Markets

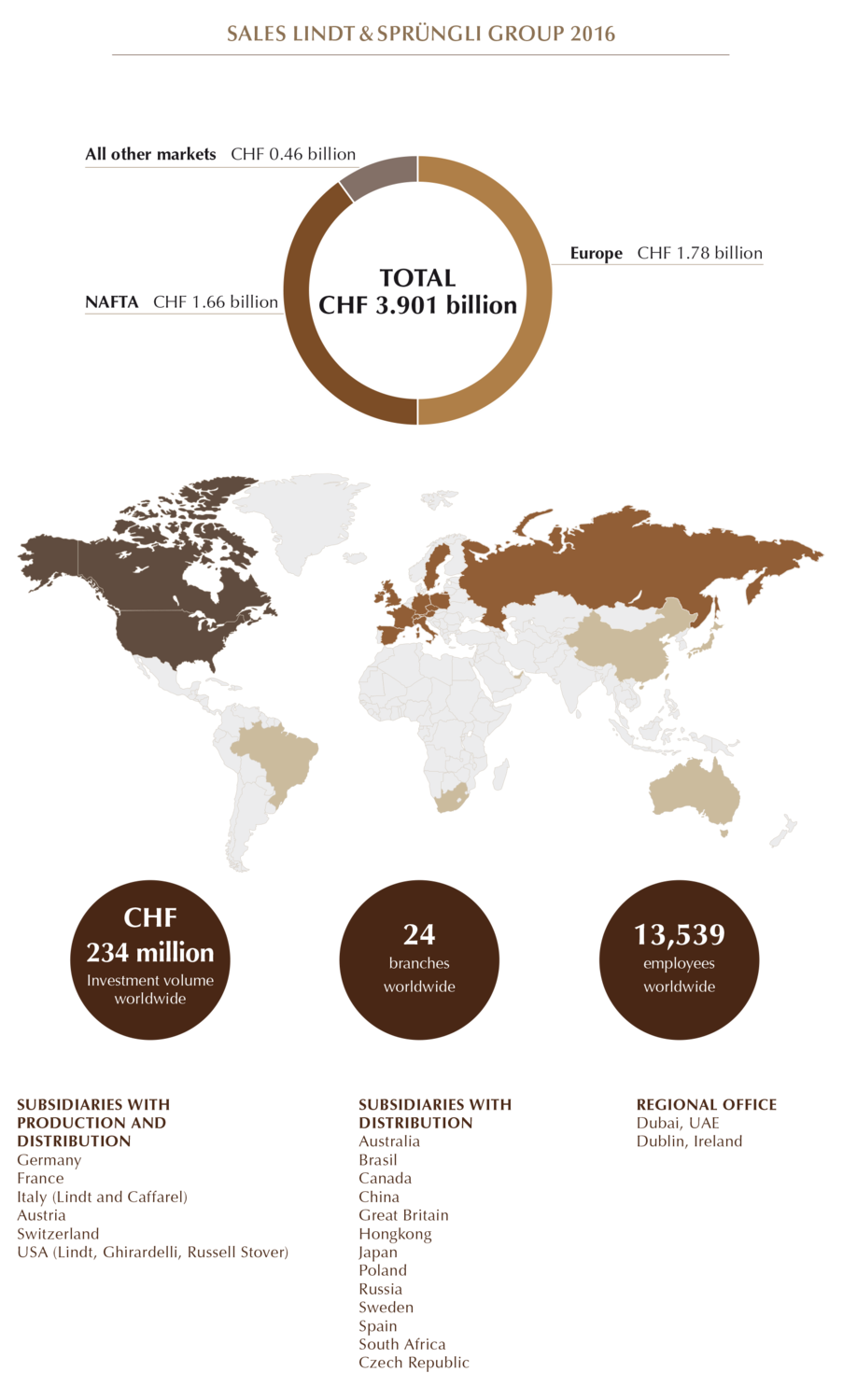

Despite a difficult environment, Lindt & Sprüngli was able to increase Group sales by 6.8% to CHF 3.901 billion and to strengthen its market position in all important markets.

Chocoladefabriken Lindt & Sprüngli AG achieved a pleasing sales growth in Swiss francs of 6.8% to CHF 3.901 billion in a difficult environment. The main challenges in 2016 included contracting – and in some cases stagnating – chocolate markets, persistently high raw-material prices for cocoa beans and cocoa butter, and generally subdued consumer sentiment. Adjustments within the product portfolio and price increases had a negative impact on Group growth, but on the other hand provide the long-term foundation for profitable growth in the future. Against this background, Lindt & Sprüngli once again succeeded in outperforming the chocolate market as a whole and gaining significant market shares.

The foreign currency situation remained very votlatile in 2016. Whereas the US dollar strengthened against the Swiss franc, pound sterling weakened. This resulted in a slightly positive currency translation effect of 0.8% in consolidated sales. The Lindt & Sprüngli Group therefore achieved organic sales growth of 6.0%, which is within the given strategic target range of 6% to 8%.

The situation in raw material markets is still very tight. Prices for cocoa beans and cocoa butter have continued to rise due to poor main and interim harvests in West Africa caused by bad weather conditions. This was partly compensated by lower prices for almonds and packaging materials. Prices for hazelnuts remained high due to a poor harvest in 2016. Milk and sugar prices are also persistently high. Lindt & Sprüngli is countering these negative effects with internal programs to boost efficiency and save costs.

To ensure maximum consistency in reporting, the presentation of the “Markets” chapter in this annual report has been revised according to the segment reporting in the finance section. As a result, the reporting of business performance in 2016 will now be organized into the segments Europe, NAFTA and Rest of the World.

Europe

The key markets for chocolate in Europe are largely saturated. The financial performance of individual markets was very mixed. Lindt & Sprüngli’s sales growth was better than average in a number of mature markets such as Germany, France, the UK, Ireland, and Austria, but also in less developed markets in more northerly countries, the Czech Republic, Poland, and Russia. Overall, Lindt & Sprüngli’s Europe segment achieved encouraging sales growth of 7.4%, to reach CHF 1.78 billion.

Consumer sentiment remained depressed in Switzerland during the reporting year. An annual comparison showed that Swiss households once again made more purchases abroad, with a further increase in cross-border shopping. Average prices dropped and Switzerland’s chocolate market shrank due to intensified and continuous price campaigns in the competitive environment.

In Germany, the moderate upturn of recent years continued, driven mainly by the strong private consumption resulting from an increase in real disposable incomes. The French economy is suffering from a significant slowdown in tourism in the wake of terrorist attacks primarily in large cities such as Paris and Nice. The overall chocolate market still achieved moderate growth, however, driven by product innovation by market participants. The economic and political environment in Italy has stabilized after years of downturn and high unemployment. Italy’s gross domestic product and private consumption recorded modest growth and unemployment fell slightly. Meanwhile in the United Kingdom, the fallout from June’s Brexit referendum on leaving the European Union had a negative effect on the market environment. The inflow of foreign capital appears to be declining, posing a threat to London’s standing as an international financial center.

switzerland

Chocoladefabriken Lindt & Sprüngli (Schweiz) AG achieved sales of CHF 356.2 million in the 2016 financial year (previous year: CHF 359.0 million). This figure includes both the Swiss market and the export business, which is in the financial reporting mainly covered in the segment Rest of the World. Overall sales are slightly down on the prior year, as the distributor business in Brazil and Denmark is now being managed through the relevant subsidiaries Brazil and Nordics. This had relevant effects on sales in Switzerland, which would have otherwise posted a small gain of 2.5%.

Against the backdrop of a generally challenging market environment, greater focus was placed on leading brands, the active development of new market segments, and fresh methods of differentiation. Lindor once again took center stage during the reporting year. Products such as Lindor Strawberry & Cream, along with other seasonal recipes, were successfully introduced, numerous sampling activities organized and supported by active communication throughout the year.

The #mylindormoment campaign explored new marketing channels and actively involved consumers. All these measures helped to further expand the leading market position and generate additional sales growth. The stronger focus on the leading brands Excellence and Les Grandes in the two strongest-growing chocolate segments, dark and block chocolate, has paid off as well. New, attractive varieties and different offerings created further growth momentum and helped to win additional market share.

While other competitors have continued to expand their sales channels through hard discounters, Lindt main-tained its consistent policy of relying on quality, innovation, and selective distribution. To project a more upmarket image, new premium shop-in-shop presentations were launched, thereby ensuring a consistently polished product presentation. This style of brand showcasing not only created sustainable growth momentum, but also helped to win additional market shares.

The Lindt Chocolate Competence Foundation is investing in the construction of a new Chocolate Competence Center at the Kilchberg site. This new center will not only focus on research and development, but also on displaying and communicating know-how and expertise in chocolate making, thereby helping to reinforce and enhance Switzerland’s standing as a center of excellence for chocolate production. In the year under review, preparations were successfully completed and construction has started at the beginning of 2017.

The Swiss Premium Chocolate Collection comes in a traditional packaging.

germany

With sales worth EUR 504.9 million (previous year: EUR 458.1 million), Chocoladefabriken Lindt & Sprüngli GmbH once again managed to exceed the strong sales growth of previous years. The subsidiary further increased its share of the German market, with sensational sales growth of 10.2%.

This impressive growth is the result of focusing on successful classics such as Lindor, Excellence, and hollow chocolate figures, as well as numerous product innovations. These classic offerings were effectively augmented by products designed to trigger an emotional response, such the female teddy bear in a pink outfit, which met with strong demand from all sides. The launch of these product extensions was supported by a tailor-made advertising campaign. In the run-up to Christmas, from September to December, demand was steadily cranked up by the sales team by means of TV spots and prominent placements. The strong growth of the Excellence tablet range, especially the products containing at least 70% cocoa solids, was also boosted by TV advertising.

An attractive summer edition was added to the successful line of mini pralinés. The young lifestyle brand Hello made a splash with a design relaunch and new seasonal products such as the Hello Santa advent calendar, Xmas Emotis, and new tablet flavors such as frozen yoghurt and crunchy crisp. The product innovatioean Chocoholic Range, available as a limited edition, gave an extra boost to the seasonal offering in the autumn.

An industry-wide survey of retailers on the company’s reputation confirmed the success of Lindt’s strategic strategy in Germany: Lindt & Sprüngli came top of the rankings of the 81 biggest suppliers to the German food & beverage business. This highlights the importance of the partnership with Lindt & Sprüngli for the trade, and builds a very strong foundation for future growth.

Lindt & Sprüngli Germany was able to further expand its leading position in the seasonal business. Targeted product innovations such as the Gold Bunny in animal print have contributed to this excellent development.

France

Lindt & Sprüngli France SAS can look back on another successful year, with sales increasing by 6.5% to EUR 351.0 million (previous year: EUR 329.5 million). In a very contested market, Lindt was therefore once again one of the fastest-growing chocolate brands and managed to strengthen its position as the country’s second-biggest chocolate manufacturer.

Lindt further consolidated its standing as the leading tablet brand by achieving solid growth in its core business. Innovative taste variations were regularly added to the key tablet lines Excellence, Création, and Connaisseurs. In addition, investments were made in new technologies for producing various filled chocolate bars, enabling rich fillings to be covered with solid chocolate.

In the seasonal business, Lindt strengthened its leading market position with the launch of new pralinés such as the Connaisseur pralinés fondants and expanded its very popular Les Pyrénéens line to include lemon, peppermint and raspberry flavors, providing a sumptuous, melt-in-the-mouth experience.

The successful launch of Sensation Fruit was a special highlight. This is a range of small balls comprising a fruit center with a crispy chocolate coating. These balls were the most successful innovations in the French market and represent a unique new category of chocolate. These balls come in three different flavors, with fruit centers of blueberry and acai, raspberry and cranberry, and pomegranate, each one covered by a layer of the finest dark Lindt chocolate. The launch of Sensation Fruit was supported by a large-scale TV campaign and carefully targeted marketing activities. In particular, a huge cube billboard structure in La Défense, one of the most heavily frequented locations in Paris, attracted a lot of attention.

Following the strong growth of previous years, the sales organization was restructured and strengthened, allowing regular visits to an extra 1,000 or so sales outlets in future.

Successful launch of innovative products such as the Création Les Macarons.

italy

In Italy, Lindt & Sprüngli SpA and Caffarel SpA achieved a consolidated result of EUR 222.8 million (previous year: EUR 216.6 million), thus achieving modest growth and a further expansion of market share in a persistently challenging environment.

The decision to continue to focus the marketing initiatives of Lindt & Sprüngli SpA on the key brands Lindor and Excellence paid off: the Excellence line in particular achieved double-digit growth backed up by stronger advertising support, improved visibility at the sales points and the general trend towards dark chocolate. The Italian production team also won the prestigious Award of Excellence from the Japanese Institute of Productive Maintenance. At the end of June, a new state-of-the-art production facility for Lindor balls was opened, thereby significantly increasing production capacity for this best seller.

Caffarel SpA distributes its products mainly through the traditional trade, which once again suffered a decline. The new strategy launched in the previous year, with a focus on product innovation, distribution expansion and development of the professional market, showed some initial positive results, however. During the reporting year, Caffarel also celebrated its 190th year with an exclusive anniversary product range. In the export business, sales to Japan and Germany posted particularly impressive gains.

Impressive Lindor promotion on the occasion of a Lindt shop opening in Monza, Italy.

united kingdom

Despite a declining chocolate market, Lindt & Sprüngli (UK) Ltd continued its strong performance of previous years, growing its sales by 14.0% to reach a total of GBP 155.0 million (previous year: GBP 136.0 million). The key line Lindor delivered an impressive performance with innovative recipes and packaging concepts for the important Christmas sales period. Sales of the Excellence line were supported by carefully targeted advertising and also posted solid growth. Easter’s large-scale treasure hunt for the Gold Bunny allowed Lindt once again to reach out to many families across the country. The link-up with the Royal Horticultural Gardens and Kew Royal Botanical Gardens close to London gave Lindt exposure to 358,000 visitors. A seasonal novelty launched in the 2016 financial year was the Lindt teddy in a Christmas pullover.

The Lindt Teddy in the UK got dressed up in a classic Christmas jumper and made hearts of chocolate fans beat faster.

austria

Lindt’s Austrian subsidiary achieved sales growth of 5.5%, once again making it Austria’s fastest-growing chocolate manufacturer. Substantial market share gains were made mainly through the Lindor line, thanks to a strong marketing campaign, the launch of Lindor Dark 60%, and solid advertising support. Posting double-digit growth, the Excellence brand further strengthened its number one position in the premium chocolate segment. On top of that, demand for the tasty little treasures Mini Pralinés was increased significantly. In the important Easter business, market shares were once again achieved with hollow figures, and during Christmas consumers were surprised with a number of Lindt innovations: eye-catching displays at Easter and Christmas in big department stores in Innsbruck and Vienna helped to raise the public profile of the Lindt brand.

Beautiful Easter decoration in the well-reputed shopping center Gerngross in Vienna, Austria.

spain

Lindt & Sprüngli (España) S.A. managed to expand its market share further, with sales growth of 7.6%. In the retail trade, the higher-than-average growth achieved by the two core brands Lindor and Excellence made a positive contribution to overall performance, supported by the new pralinés brand Dulces Deseos.

nordics

Lindt & Sprüngli (Nordic) AB, which includes the markets of Sweden, Norway, Denmark, and Finland, had another successful year, posting double-digit sales growth of 14%. The Swedish market produced a particularly strong performance, with Lindt significantly expanding its market share in the tablet segment and in pralinés, especially the sales of Lindor. On top of that, the successful Pick & Mix concept generated over 12 million consumer contacts over the past financial year.

Czech republic

Since it was established in 2008, Lindt & Sprüngli Czechia s.r.o. has enjoyed a steady rate of growth. Over the past reporting year, it once again managed to achieve double-digit sales growth. This performance is being driven mainly by the seasonal business at Easter, and specifically Gold Bunny sales, but also the growing popularity of the Excellence and Lindor lines. During the Christmas period, Lindor is already the third biggest pralinés brand in the Czech market in terms of sales volumes.

Poland

Lindt & Sprüngli (Poland) SP. z o.o. managed to significantly increase its sales over the past financial year and achieve double-digit sales growth. The decision to focus distribution and marketing activities on the key lines Lindor and Excellence is paying off. Working together with the most important Polish retailers, Lindt was able to further improve the brand’s visibility and attract new customers.

Russia

Lindt & Sprüngli (Russland) LLC once again achieved solid double-digit sales growth during the reporting year, despite the downward trend in the overall chocolate market. Lindor and Excellence were the two main growth drivers and the fastest-growing brands in Russia’s chocolate market.

Nafta

Although the overall chocolate market stagnated in North America, the NAFTA segment managed to achieve organic growth of 3.4%, with sales rising to CHF 1.66 billion. Once again, Lindt (in the USA and Canada) and Ghirardelli (in the USA) were the fastest-growing premium chocolate brands, and both managed to further expand their market shares.

The North American economy continued to make progress during the reporting period. Unemployment rates fell and there was a further modest increase in gross domestic product. By contrast, the chocolate market as a whole contracted for the first time: the overall market value stagnated and sales volumes declined. This development was the result of unfortunate timing for seasonal events, such as Valentine’s Day on a Sunday or an early Easter, coupled with high temperatures during the summer months. Although the premium chocolate segment was also affected by these market trends, it still managed to achieve above-average growth.

The newly established subsidiary Lindt & Sprüngli (North America) Inc. will produce positive synergy effects in future as a service provider for all Lindt & Sprüngli companies in the USA in centralized tasks such as sales promotions, logistics, IT, procurement, and legal counsel.

The Golden Globes are among the most important awards in the film industry right after the famous Oscars. For the second time, Lindt chocolate is enchanting this special evening in Hollywood for international stars such as Gillian Anderson, John Lithgow and Claire Foy.

Not only the elegant gowns were sparkling, but also the booth of the Lindt Master Chocolatiers where delicacies made of chocolate were handed out.

Finest chocolate creations by the Lindt Master Chocolatiers for the world’s best actors.

Lindt & SprÜngli USA

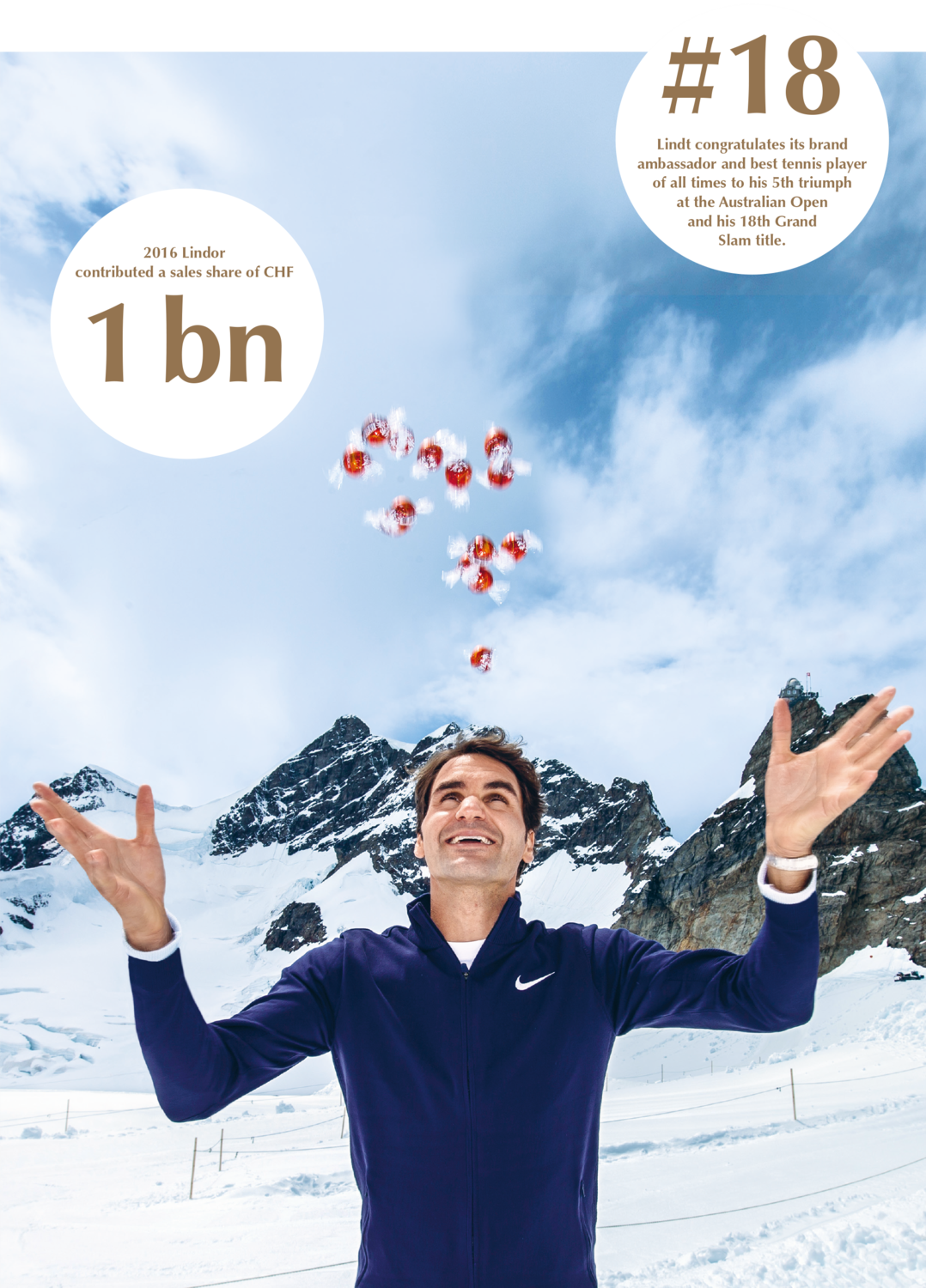

In a very challenging economic environment, Lindt & Sprüngli (USA) Inc. still managed to achieve modest sales growth of 1.3% compared with the previous year. Lindt thus maintains its position as one of the leading brands in the US premium segment. Growth is based mainly on the strong performance of the key Lindor line, which was supplemented by attractive novelties such as the limited edition Lindor Pumpkin Spice. This innovation helped to create a new mini-season in the US market for the autumn, supplementing the existing prime seasons of Christmas and Easter. Other seasonal limited editions, the further expansion of the Lindor Stick range, and large-scale campaigns to motivate consumers such as Lindor World, where more than 16 million samples of Lindor truffles were handed out, made a significant contribution to this performance. On top of that, the core products in the Excellence line continue to sell very well in the USA, spurred on by the launch of a new package with different varieties of chocolate tablets, which has boosted sales in the growing club channel. The increasing importance of the online channel is also evident, with growth passing the 20% mark.

Furthermore, the selected product samplings organized by Lindt on a grand scale have repeatedly attracted media attention. For example, the Gold Bunny celebrity auction was held during the Easter period for the eighth consecutive year to raise money for charity, while Lindt also acted as official sponsor of the Golden Globe Awards for the second time, adding a sweet note to the ceremony. These events provide the company with an opportunity to generate millions of contacts in social media with the help of high-profile influencers, and thus win over new fans to Lindt chocolate.

To cater for growing demand, production space in North America was expanded by 13,000 m² during the reporting period, and two new production lines added. This new infrastructure makes the US subsidiary ideally equipped for future growth.

GhiraRdelli Chocolate Company

Ghirardelli Chocolate Company was once again one of the fastest-growing chocolate companies in the USA, with solid sales growth of 8.9%. This performance was driven mainly by products from the established Squares line, the seasonal business, and the dark chocolate line Intense Dark. This growth was augmented by the introduction of innovative recipes and strong marketing support.

Ghirardelli also has a strong position as a premium brand in the US baking segment. It was able to further expand its leading position in this segment with products such as chocolate chips, tablets, cocoa and other innovations. Its satisfied customers include not only kitchen chefs and baristas, but also private households.

Ghirardelli Peppermint Bark Squares are ideally suited for festive Christmas decorations.

Russell Stover chocolates

During the reporting period, the process of integrating Russell Stover Chocolates into the Lindt & Sprüngli Group continued according to plan. Russell Stover has not only optimized its product range, but has also streamlined its distribution network and adjusted price conditions. Sales were therefore slightly down on the previous year. The measures taken will improve the company’s profitability in future. New seasonal products for Christmas, Valentine’s Day, and Easter were launched very successfully and will strengthen the core business and market leadership in the gift-oriented segments. Russell Stover has also pushed ahead with digitalization. The ramping-up of online advertising and the growing social media presence both helped to fuel interest and strengthen dialogue with consumers.

Russell Stover successfully launched new seasonal products and thus further expanded its core business.

Lindt & SprÜngli Canada

The performance of the Canadian subsidiary was once again very impressive in the past financial year, with sales growth of 13.1%, consolidating Lindt’s position as one of Canada’s fastest-growing chocolate manufacturers. Such success in a very fiercely contested market allows the company to actively focus on the core brands Lindor and Excellence, further increase its market shares, and in the process generally strengthen Lindt’s standing as market leader in the premium segment. Apart from the core products, a series of attractive product launches and the creative, multilayered marketing campaign for the Christmas season also contributed to this performance. Around 45,000 consumers voted for Lindt as Canada’s most trusted chocolate brand during the past financial year.

All other markets

The strategy of geographic expansion pursued over previous years is now starting to pay off. The Rest of the World segment made significant gains, with organic growth of 10.2% pushing sales up to CHF 457.1 million and providing an increasingly significant contribution to consolidated sales. The national markets belonging to this segment continue to enjoy dynamic and higher-than-average growth rates. The performance of the Brazilian and Japanese subsidiaries was particularly impressive, with growth rates in the high double digits.

Australia

Australia’s chocolate market was stagnant, with deflation dampening consumer sentiment during the reporting year. Despite this backdrop, Lindt & Sprüngli (Australia) Pty. Ltd. managed to achieve sales growth of 6.7% and further expand its market shares. The core brand Lindor once again enjoyed excellent sales growth. Excellence was also able to further strengthen its position as market leader in the dark chocolate segment. One highlight worth mentioning is the official opening of the new Marsden Park facility in July 2016. The new site, which cost over 60 million Australian dollars to build, provides secure jobs to around 350 staff.

Official opening of the new office and warehouse building in Australia with Prime Minister of New South Wales Mike Baird as well as Ernst Tanner and Steve Loane of Lindt & Sprüngli.

South Africa

Five years after its foundation, Lindt’s South African subsidiary continues to expand, achieving double-digit sales growth. The strong performance was driven not only by the Lindor and Excellence lines, but also by the Hello range, which is now well established. On top of that, the two chocolate studios in Johannesburg and Cape Town attract with exciting workshops around chocolate making new chocolate fans and at the same time further raise awareness of the Lindt brand.

united arab emirates

Lindt & Sprüngli’s regional office in Dubai serves markets in the Middle East, India, and the Rest of Africa. For the first time in many years, growth was only moderate in this region due to the deteriorating economic situation in many Arab countries. In Iran, formalities for market entry were successfully concluded after sanctions were lifted. This makes Lindt the first legitimately available foreign chocolate brand in this new market. In India business was resumed, after import barriers have eventually been overcome after two challenging years.

Gold Bunnies for the good cause: Lindt & Sprüngli (South Africa) supports the charitable organization «Reach for a Dream».

china/asia pacific

Lindt & Sprüngli (China) Ltd. posted satisfactory results in a challenging market environment. Sales figures in the metropolitan areas of Shanghai and Beijing were particularly impressive, along with Internet sales. Lindt gained market share in Hong Kong through its Excellence and Lindor lines. Dynamic sales growth of the key Excellence line helped Lindt to achieve a good performance in Singapore. Lindor sales also followed a positive path, especially in the period between Christmas and New Year. Despite a challenging environment, Lindt managed to expand its market shares in Hong Kong. The Excellence dark chocolate bars established themselves as market leaders. There was also buoyant demand for Lindor truffles. Lindt products are now available in well-stocked supermarkets in Brunei as well.

Japan

Lindt & Sprüngli Japan Co. Ltd continues its vigorous performance, posting strong double-digit growth. Here the products are mainly available in Lindt’s own chocolate boutiques and cafés, as well as in major department stores. The expansion in the North East of the country helped to ramp up the distribution of Lindt products in Japan during the reporting period.

Brazil

In 2016, Brazil suffered not only from political instability, but also one of the worst economic crises of the past 100 years. Despite this turbulent market environment, Lindt still managed to establish itself as the country’s leading premium chocolate brand, building on the joint venture with CRM Group as a platform. In Brazil, Lindt products are mainly available in 28 of Lindt’s own chocolate boutiques, as well as in selected department stores.

Duty Free/Travel Retail

In view of the difficult economic and political situation in many countries, combined with currency translation effects and terrorist attacks, the travel retail chocolate market stagnated in 2016, despite rising passenger volumes. In spite of this backdrop, Lindt & Sprüngli managed to achieve significant growth thanks to a high proportion of product innovations and support measures. It was one of the few market players to expand its market share and further strengthen its presence. New shop-in-shop concepts were implemented in various large airports with high passenger volumes, including Hong Kong, Dubai, Mumbai, Rio de Janeiro, Nice, and other major cities.

One big success was the launch of Lindt Swiss Masterpieces, a collection of the finest assorted Swiss pralinés. The Lindor line posted double-digit growth, partly thanks to the new Limited Editions and the Love Lindor Range. Last but not least, the important sales of chocolate Napolitains and tablet products were also very strong. Lindt was able to significantly expand its presence over the competition and boost sales with special travel souvenir products. The product presentation was rounded off by the impressively orchestrated Swiss Chocolate Festival, where the Lindt travel retail bestsellers were combined with live tastings.

The Lindt Chocolate Trolley is the perfect accessoir for every trip.